- Practice Areas+

- Consumer Bankruptcy+

- Business Bankruptcy+

- Bankruptcy Alternatives+

- Debt Relief+

- Bankruptcy FAQ+

- How Do I Know What Chapter Of Bankruptcy To File?+

- How Many Times Can I File For Bankruptcy?+

- If I’m Married, Will My Spouse Have To File Bankruptcy With Me?+

- What Happens When I Go To Court For Bankruptcy?+

- Will Bankruptcy Stop Car Repossession?+

- Will Bankruptcy Stop Creditor Harassment?+

- Will Bankruptcy Stop Foreclosure?+

- Will Bankruptcy Stop Wage Garnishment?+

- Will I Lose My Home If I File For Bankruptcy?+

- Bankruptcy Tips+

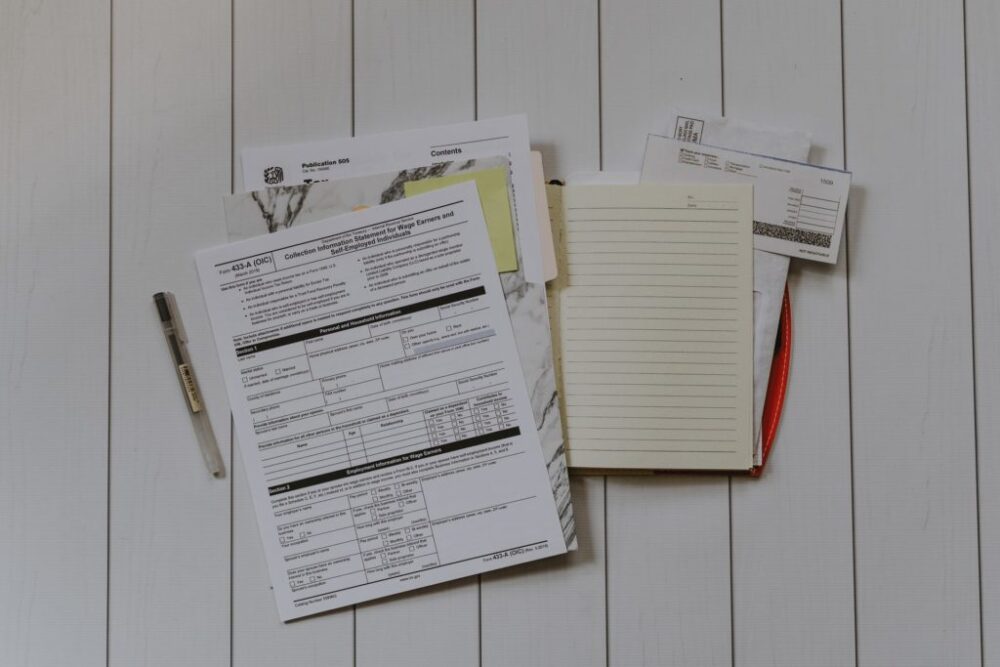

- Bankruptcy Forms & Worksheets+

- Our Firm+

- Testimonials+

- Blogs+

- Contact+

- Pay Now+

- Search+