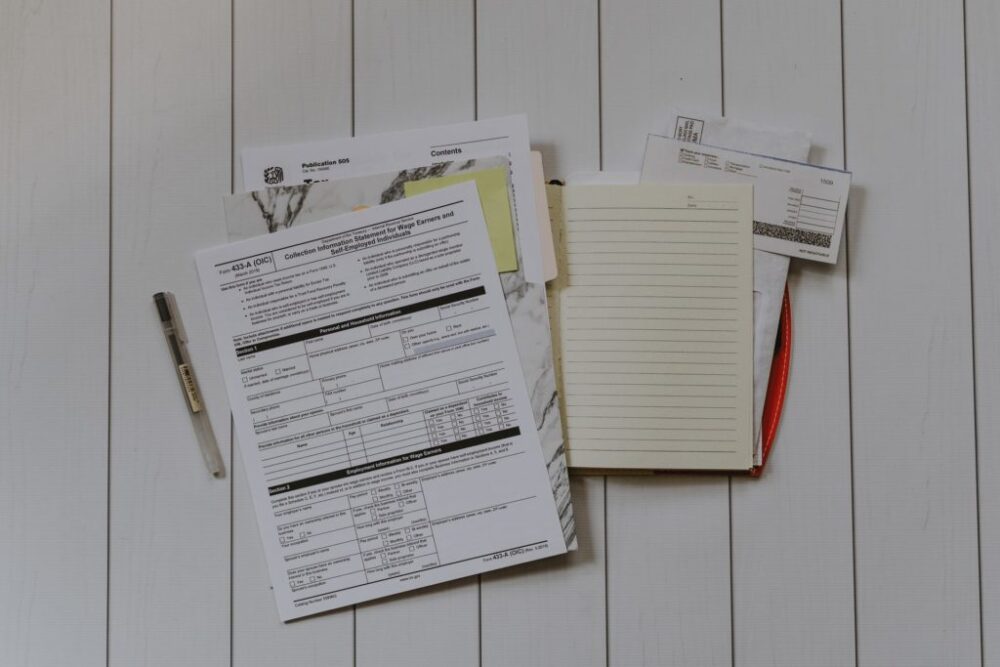

Upon filing a bankruptcy petition, your assigned bankruptcy trustee may take control of certain assets, in which you have legal and equitable interests, and place them in your bankruptcy estate. From here, they may liquidate these assets to ultimately pay off your unsecured debtors. With this, it may be difficult to navigate which assets may be exempt or non-exempt from your bankruptcy estate. Follow along to find out whether your tax refund is exempt and how a proficient Louisville, Kentucky consumer bankruptcy lawyer at Schwartz Bankruptcy Law Center can work to protect your assets.

Is it possible for my tax refund to be exempt from my bankruptcy estate?

The short answer is, no, your tax refund may not be exempt from your bankruptcy estate. This is because the Kentucky bankruptcy court may treat your overpayment of necessary taxes the same as your stocking of extra money in a bank account; the only difference is that this extra money is temporarily stocked with the IRS.

Overall, any pre-petition tax refunds may be subject to your bankruptcy estate. So your refund for the tax year 2022 may be acquired by your bankruptcy trustee. Or, your refund of late filing for tax years 2022, 2021, 2020, etc. may be acquired as well.

More specifically, your Chapter 7 bankruptcy may not include tax refunds based on the income you earned after filing. But as far as Chapter 13 bankruptcy goes, tax refunds based on the income you earned after filing may be ongoing and therefore part of your bankruptcy estate. This is due to Chapter 13’s three- to five-year repayment plan.

What other assets are non-exempt from my bankruptcy estate?

Unfortunately, there are additional assets that may be left non-exempt. They are as follows:

- Assets that are not in your direct possession, such as your security deposits.

- Assets that you are entitled to receive, such as your cash receivables.

- Assets that you acquire after filing, such as your marital settlement agreement.

- Revenue from your estate property, such as your investment rental property.

- Assets you have (fraudulently) transferred before filing.

- Payments you have made to (preferential) creditors before filing.

However, you may rest assured knowing that you may possess certain assets that are indeed exempt. Examples read as follows:

- Your personal residence, up to a certain dollar amount.

- Your motor vehicles, up to a certain dollar amount.

- Your cash on hand, up to a certain dollar amount.

- Your household goods, up to a certain dollar amount.

- Your jewelry, up to a certain dollar amount.

- Your retirement plan.

- Your life insurance policy.

- Your workers’ compensation benefits.

Regarding your bankruptcy petition, there is no time like the present to get started. So please reach out to a talented Louisville, Kentucky consumer bankruptcy lawyer from Schwartz Bankruptcy Law Center at your earliest possible convenience.