Filing for bankruptcy requires providing the court with information about your finances. It is essential to ensure that when you file your petition, you include everything the court needs.

Missing information or documentation could delay your case or result in the court throwing it out. The US Courts explains you could end up having to start the process over from the beginning if you turn in an incomplete petition.

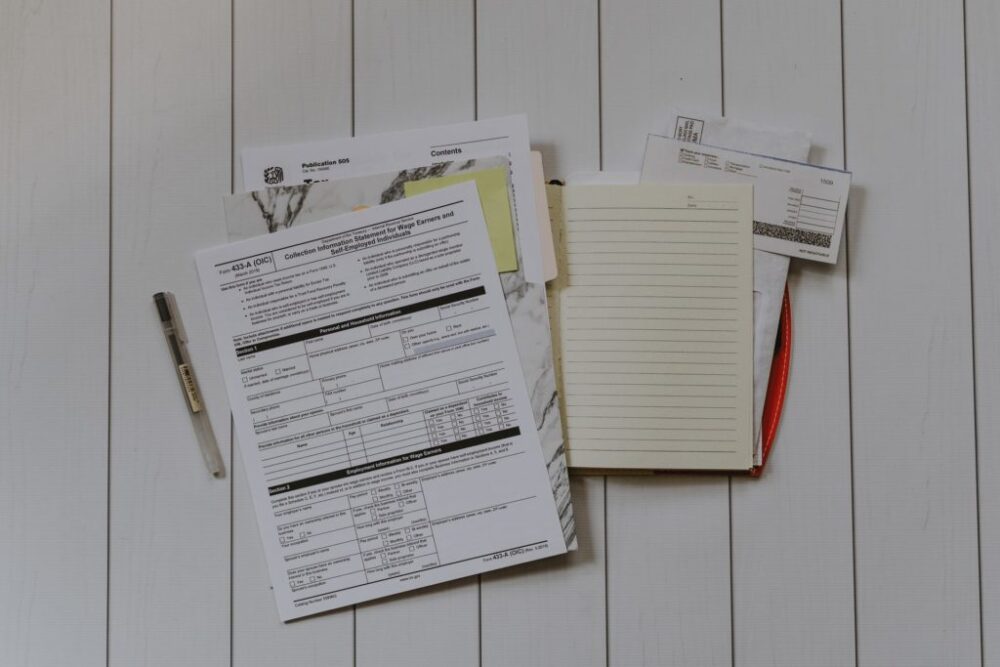

Financial documents

You will need to provide a complete picture of your finances. You need to have pay stubs or other proof of income. You need old tax returns and any other documentation about financial accounts. Your petition should completely outline all income you have and all sources of earnings you have. Do not forget to include these important documents because it could be construed as you trying to hide income, which could result in you being ineligible to refile or even charges against you for fraud.

Debts

When you file for bankruptcy, the court only looks at the debts you include in your petition. Make sure you include everything. This even applies to debts that you may wish to reaffirm. You need to include every debt you wish to get rid of and those you do not to give the court a full picture of your finances and debt situation. If you leave a debt out of your filing, the bankruptcy rules will not apply to it, and the court cannot discharge it as part of your case.

Other details

The court will also need to see your credit counseling documentation. You have to take two courses, and you must have a certificate of completion for each to provide to the court.

Not including all the documentation required in your bankruptcy petition will cause you issues. Make sure you know everything you must include and go over your petition prior to filing to ensure you provided a complete file.