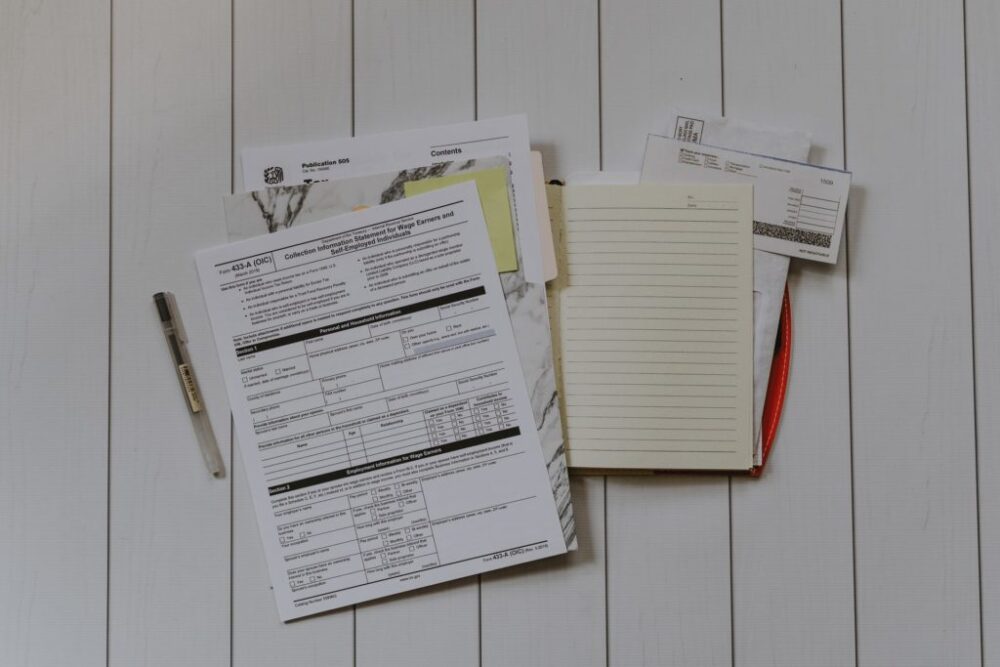

Facing Wage Garnishment Because Of Debt

Maintaining financial security can be incredibly challenging when facing mounting debt, especially if your wages are being garnished by creditors or your bank accounts have been frozen by a bank attachment. Garnishments or attachments can occur following delinquency on any financial obligation. A wage garnishment can take up to 25 percent of your paycheck and a bank attachment can take the entire balance of your bank account, oftentimes making a difficult situation even worse.

At Schwartz Bankruptcy Law Center, we understand the impact garnished wages and bank attachments can have on an individual and their family. For most people in these situations, they are already struggling to pay their bills, and now what limited financial resources they have are diminished. We’ve helped others in the past, we can help you too.

How Do You Effectively Fight Wage Garnishment?

If your wages are already being garnished, then you have few options because once your employer has received the notice of the garnishment, they must comply.

To secure a wage garnishment, the creditor has to seek a judgment in court. The creditor need only make one attempt at notifying you that they are seeking a judgment on your debt. If you fail to answer the complaint in writing, they will receive a default judgment and use that as the basis for a garnishment.

If you are already having trouble making payments on your bills, then you might consider fighting the wage garnishment. With the help of a skilled lawyer, you may be able to fight wage garnishment with a bankruptcy petition.

How Can Bankruptcy Help Fight A Wage Garnishment?

Both Chapter 7 and Chapter 13 bankruptcy contain a provision called an automatic stay that causes all collection activities to immediately cease, including most garnishments, upon filing a bankruptcy case. Garnishments for unpaid child support are one of the few exceptions. They are not affected by a bankruptcy petition.

Personal bankruptcy and its automatic stay is one of the few tools that can fight a garnishment. Even though a creditor may not want to let the garnishment go, they have to once they receive notice of a filing for Chapter 7 and Chapter 13 bankruptcy. The stay grants you the time you need to sort out your finances and work through your debt.

Contact Us

At Schwartz Bankruptcy Law Center, our qualified attorneys walk you through your options and the steps you need to stop wage garnishments and bank attachments. We explain your rights to you and will make sure you’re making debt relief decisions that make the most sense for your situation.